THANK YOU FOR SUBSCRIBING

Editor's Pick (1 - 4 of 8)

Interconnected Trust - The Digital Economy's Renewable Energy

Rocky Scopelliti, Director at Optus Futurologist & Author, Youthquake 4.0

Rocky Scopelliti, Director at Optus Futurologist & Author, Youthquake 4.0

We make these decisions routinely such as reviews on travel destinations, accommodation on Airbnb, Uber rides, news, goods and services. What other people think about a product, service, organisation or person is based on past experiences that have accumulated over time or the reputation of the individual giving the review, which forms a measure of trustworthiness.

We make these decisions routinely such as reviews on travel destinations, accommodation on Airbnb, Uber rides, news, goods and services. What other people think about a product, service, organisation or person is based on past experiences that have accumulated over time or the reputation of the individual giving the review, which forms a measure of trustworthiness. These platforms make both sides of the transaction accountable, but not infallible. Reputation therefore is what Botsman describes as ‘trust’s closet sibling’.

But technology and machines also require trust and reputation particularly in light of the tsunami of sensors, objects, devices, robotic and autonomous vehicles now in development and use. How would you feel skiing down a slope when you’re overtaken by a robot on skis – what if they pushed in to the lift queue? What are the protocols? How do you address the intrusive machine? How do you look to other humans or robots in the queue?

Our relationship with technology is asynchronous. Our trust in technology is primarily centred on its functionality and the reputation of the manufacturer. But this is now changing. Our relationship with emerging technologies is becoming synchronous; our trust is shifting from trusting the technology and the reputation of the manufacturer to perform a task, to one that makes decisions and carries them out. These are decisions that put our lives in the hands of a software program of technology that thinks and learns. It becomes artificially intelligent.

How do we go about trusting technology?

This is the very question many of us are asking today with technologies such as artificial intelligence permeating many more aspects of our lives. For example, we ask Chatbots daily for information or to book taxis. We need to ask the question how do we go about trusting technology? After all, without trust, we simply won’t use it right.

Botsman’s research suggests that part of the answer can be explained with anthropomorphism – where the technology has human like tendencies and qualities, emotions and appearances. Studies have identified that self-driving vehicles that include anthropomorphic features via voice interactivity increased trial participants’ trust in the driverless vehicle. Early speech recognition systems and the first generation of interactive technologies blurred the boundaries between human and non-human. Researchers believe that we have a tendency to anthropomorphise technology because we are more likely to trust things that look, and sound like us.

A new approach to distributing trust

Distributed trust is defined as trust that flows laterally between individuals, enabled by networks, platforms and systems. Distributed trust is underpinned by the principle of ‘decentralisation’ where authority is transferred to uses away from central authorities such as governments, institutions, banks, or business. In the context of trust, it disperses functions, powers, people or things away from requiring an intermediary to confirm trust, where the network of computers confirms trust through a shared ledger recorded on a blockchain. The record is mathematically proven and hence immutable.

As a trust technology, blockchain has features that provide real-time validation, non-repudiation, configuration verification, transfer of risk etc. For example:

• Validation of transaction chains, such as Bitcoin

• Settlements for international financial payments, or share trading

• Data flows as with smart contracts

• Chain of custody, which has important applications in the agricultural, pharmaceutical where preparations can be tracked from providence to end user through supply chain mapping.

Blockchain has also been referred to as the ‘internet of value’, as the technology is a very significant transformative overlay on the internet that disaggregates, disintermediates and dematerialises value chains across many industries. Futurist Marc Andreessen has called it the most important technology since the internet itself.

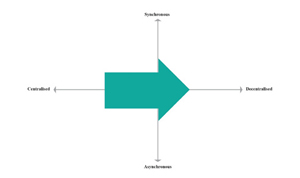

Let’s now bring these points together. In order to adapt trust to accommodate our digital lives, and its coverage to include additional actors, operating in a decentralised and real-time way, requires extending the topology from a centralised hierarchical position, into a decentralised position. I call this interconnected trust (see Figure 1) where actors or assets can be commissioned to perform the trust element within the synchronicity desired by the activity.

As so well articulated by Joseph Stiglitz: ‘It is trust, more than money, that makes the world go around’. Trust, is it the most important enabler for all that the 4th Industrial Revolution has to offer. It can not be an after-thought, but rather by design.

See More: Top Travel and Hospitality Solution Companies

Weekly Brief

I agree We use cookies on this website to enhance your user experience. By clicking any link on this page you are giving your consent for us to set cookies. More info

Read Also

Navigating Compliance Challenges in ESG AML and Digital Onboarding

Chuan Lim Ang, Managing Director and SG Head of Compliance, CIMB

A Vision for the Future: Automation, Robotics, and the Smart Factory

Joe Tilli, State Industrial Automation Sales Manager, Lawrence & Hanson

The Rise of Hyper Automation

Erdenezaya Batnasan, Head of IT End-User Support Service Department, Khan Bank

Transforming Business Operations with Robotic Process Automation

Simon So, CMGR, MCMI, Regional Head of Digital Solutions, Richemont Asia Pacifi

Combining Automation with AI to Achieve Human-Like Interaction

Kain Chow, General Manager, Technology & Transformation, New World Development Company Limited

Implementing RPA - 5 Ultimate Prerequisite

Indra Hidayatullah, Data Management & Analytics Division Head, Pt. Bank Tabungan Negara

Incorporating the power of recognition into our vendors' sustainability journey

Cynthia Khoo, Head, Central Procurement Office, OCBC Bank (Malaysia) Berhad

Elevating Guest Experience with Data

Clive Edwards, Senior Vice President, Operations, Capella Hotel Group